Banking, Financial Services, and Insurance (BFSI)

Drive innovation, customer satisfaction, and shareholder value by embracing the power of data and automation.

Bringing digital maturity to respond disruptive forces

Increasing competition from traditional sources and FinTech disruptors has created the need to offer personalized products-services, handle regulatory compliance and rapidly evolving business models, address cyber-security concerns, and create digitally transformed customer experiences. Technology has become a cardinal element in addressing these sectoral challenges. BFSI firms must do more for customers in every industry and find ways to exceed expectations despite margin pressure. As customer expectations continue to grow, financial institutions must be prepared to adapt and exceed expectations to stay ahead of the competition.

When making tech investments, firms should consider how the technologies will enable them to transform strategies and improve their ability to respond to disruptive forces. This will require banks to challenge their long-established conventions and beliefs. By doing so, they can maximize the value of their tech investments and ensure they can navigate the challenges of the modern business landscape.

Key Industry Challenges

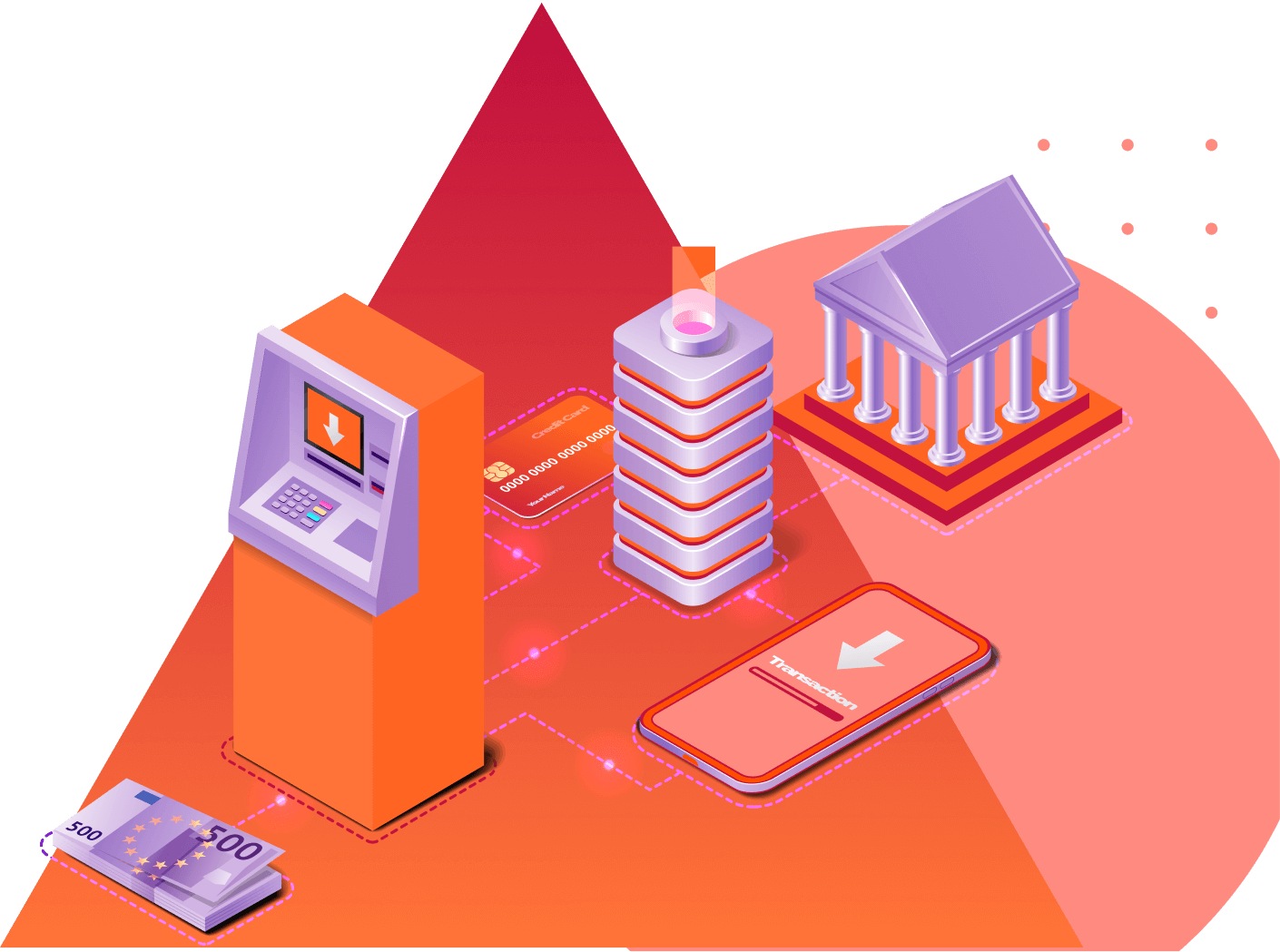

Cloud Migration to Oracle Cloud Infrastructure for a leading American health and insurance customer

The company wanted to migrate to Oracle Cloud to standardize and stabilize their applications, while also achieving cost savings and increased flexibility. They were using a “Lift and Shift” method for existing applications and want a good migration strategy to avoid business disruption. The solution being offered is an out-of-the-box temp DG configuration for migrating large databases to OCI, with a high-level roadmap for costs and schedule. Automation tools are being used for migrations, re-configurations, and testing.

Service Offerings

Digital Banking

Application Management Services

Advanced Data &Analytics

Digital Transformation & Advisory

Application Development

Custom ERP Management

Spot Light

Why Choose Us for Banking, Financial Services, and Insurance industries

S-Square has a team of highly skilled and experienced professionals who have worked with some of the largest banking and financial institutions in the world. We offer a wide range of services that helps organizations across the financial sector assess potential pathways and make the transformative moves necessary to thrive. We deeply understand the regulatory landscape, and our experience handling large organizations will surely enable our clients to outperform. Our services include but are not limited to optimizing transaction processing costs, navigating increased regulatory requirements, modernizing legacy systems, and designing engaging customer journeys.

Our Perspectives

RPA vs. AI Agents vs. Agentic AI – What Works Best for Automation in Businesses?

Table of Content Introduction Understanding Today's Automation Options Choosing the...

The Future of Workday AI

Table of Content Introduction Understanding the Current Workday Landscape The...

Agentic AI: The Future of Enterprise Application Solutions

Across Silicon Valley and global enterprises, "Agentic AI" has emerged as the...