Introduction:

The financial industry is undergoing a significant transformation, driven by the need to reduce costs, increase efficiency, and meet regulatory compliance requirements. Robotic Process Automation (RPA) has emerged as a powerful tool that can help financial organizations achieve these objectives. Among the various RPA solutions available, akaBot RPA has gained significant traction due to its robust features and capabilities. In this blog, we will explore the reasons why it is essential for the financial industry, focusing on its ability to save costs and meet goals.

Why akaBot Robotic Process Automation (RPA) is Helpful and Needed for the Financial Industry:

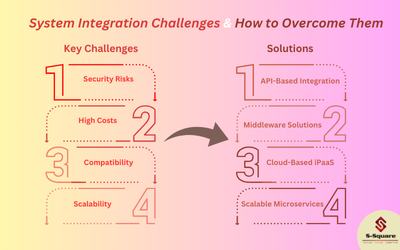

Cost Savings: akaBot RPA can help financial organizations reduce costs by automating repetitive and time-consuming tasks, such as data entry, report generation, and account reconciliation. By automating these tasks, financial organizations can free staff to focus on higher-value tasks, such as customer service, risk management, and strategic planning. Moreover, it helps financial companies reduce errors, improve accuracy, and enhance productivity, leading to further cost savings.

Meeting Goals: akaBot RPA can help these institutions meet their goals by enabling them to process transactions faster, improve customer service, and enhance operational efficiency. By automating repetative tasks, companies can reduce turnaround times, improve response times, and provide a better customer experience. Moreover, it can help financial institutions meet regulatory requirements, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, by automating the verification and validation of customer data.

Regulatory Compliance: akaBot RPA can help financial institutions meet regulatory compliance requirements by automating the verification and validation of customer data, ensuring that all transactions are processed in accordance with regulatory requirements. By automating compliance checks, companies can reduce compliance risks, improve compliance monitoring, and ensure that they are always in compliance with regulatory requirements.

Efficiency Gains: akaBot RPA can help business in finance gain efficiency by automating routine tasks, such as data entry, report generation, and account reconciliation. By automating these tasks, financial firms can reduce cycle times, improve turnaround times, and enhance operational efficiency. Moreover, this can help financial companies streamline their processes, reduce errors, and improve accuracy, leading to further efficiency gains.

Digital Transformation: akaBot RPA can help financial organizations undergo digital transformation by enabling them to automate repetative tasks, improve operational efficiency, and enhance customer service. By automating repetative tasks, firms can free up their staff to focus on higher-value tasks, such as customer service, risk management, and strategic planning. Moreover, this can help financial institutions leverage data analytics, machine learning, and artificial intelligence to gain insights, make informed decisions, and drive business growth.

How akaBot Robotic Process Automation (RPA) Works?

It works by using software robots to automate repetitive and time-consuming tasks. These software robots can be programmed to mimic human actions, such as processing paper and electronic forms, entering data, and complete tasks. By automating these tasks, financial service providers can reduce routine, repetitive workload from staff, freeing up their time to focus on higher-value tasks.

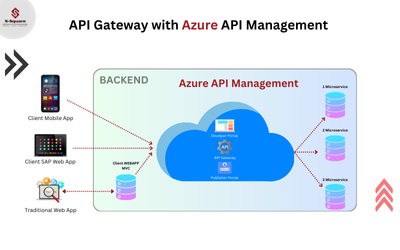

It can be integrated with various financial systems, such as core banking systems, loan origination systems, and accounting systems. This integration enables akaBot RPA to automate tasks across various systems, improving operational efficiency and reducing errors.

It can be deployed on-premises or in the cloud, depending on the company’s requirements. On-premises deployment provides greater control over the RPA environment, while cloud deployment provides greater flexibility and scalability.

Key differentiators of akaBot Robotic Process Automation (RPA):

Can Run On Top of Environment: akaBot Robotic Process Automation software is able to integrate with applications through industry standard APIs. But uniquely, it also has the ability to run on top of an environment eliminating the need for programmatic integration. Just as an employee logs into the various computer systems required to do the majority of their repetitive tasks, akaBot Robotic Process Automation software can be assigned a username and password and function as an electronic employee logging into the various computer systems required to automate these same repetitive tasks. Legacy or 3rd party applications become uniquely accessible for akaBot Robotic Process Automation software making it a more versatile offering that heavily marketed competitive alternatives.

Generally, it Runs Faster: akaBot Robotic Process Automation software Bots generally run faster than Bots from heavily marketed competitive alternatives. Bots are programmed to repetitively run a set of steps. Therefore, akaBot Robotic Process Automation software will generally need LESS Bots than heavily marketed competitive alternatives.

Generally, Licenses Cost Less: The licenses for akaBot Robotic Process Automation software generally cost less than heavily marketed competitive alternatives. As a result, akaBot Robotic Process Automation software customers generally spend less than what they spend for heavily marketed competitive alternatives.

So users of akaBot Robotic Process Automation software realize more value delivered through access to otherwise unaccessable environments, require less licenses and spend less for each license acquired than heavily marketed competitive alternatives.

Benefits of akaBot Robotic Process Automation (RPA) for Financial Institutions:

Improved Accuracy: It can help financial institutions improve accuracy by reducing errors and eliminating manual data entry by automating repetative tasks, organizations can reduce the risk of human error, ensuring that data is accurate and up-to-date.

Increased Productivity: Financial firms can unlock new levels of productivity by automating repetative tasks, staff can focus on what matters most – strategic initiatives and client relationships – while also experiencing faster turnaround times and improved operational efficiency.

Reduced Costs: This can help financial institutions reduce costs by automating repetative tasks, reducing errors, and improving accuracy. By automating tasks, your company can reduce the workload on their staff, freeing up their time to focus on higher-value tasks.

Improved Compliance: It also helps companies improve compliance by automating compliance checks, reducing compliance risks, and improving compliance monitoring. By automating compliance checks, you can ensure that you’re always in compliance with regulatory requirements.

Enhanced Customer Service: akaBot RPA can help financial institutions enhance customer service by reducing turnaround times, improving response times, and providing a better customer experience. By automating repetative tasks, financial institutions can free up their staff to focus on higher-value tasks, such as customer service, risk management, and strategic planning.

Best Practices for Implementing akaBot RPA in Finance industry:

Define the Business Case: Financial institutions should define the business case for akaBot RPA, including the expected benefits, costs, and ROI. This will help ensure that the implementation is aligned with the institution’s strategic objectives.

Identify the Right Processes: Financial institutions should identify the right processes to automate, focusing on those that are repetitive, time-consuming, and prone to errors. This will help ensure that the implementation delivers the expected benefits.

Select the Right Vendor: Companies in Finance industry should select the right akaBot RPA vendor, based on their capabilities, experience, and reputation. This will help ensure that the implementation is successful and delivers the expected benefits.

Invest in Change Management: Financial providers should invest in change management programs, including training, communication, and support, to ensure that staff are prepared for the changes and can adapt to the new way of working.

Monitor and Optimize: Financial agencies should monitor and optimize the aBot RPA implementation, including performance, compliance, and ROI. This will help ensure that the implementation continues to deliver the expected benefits and can be adapted to changing requirements.

Conclusion:

In conclusion, akaBot RPA is essential for the financial industry, as it can help financial institutions meet regulatory compliance requirements, gain efficiency, and undergo digital transformation. Moreover it can assist business reduce errors, improve accuracy, and enhance productivity all leading to cost savings. As the financial industry continues to evolve, akaBot RPA will become increasingly important, enabling financial institutions to stay competitive, meet regulatory requirements, and drive business growth.

The financial benefits of RPA are undeniable. Studies show that RPA can:

-

- Reduce Operational Costs by 25-50% through automation of labor-intensive tasks.

- Increase Processing Speed by up to 80%, significantly improving turnaround times.

- Minimize Errors by up to 90%, leading to cleaner data and reduced rework.

- Enhance Compliance Capabilities, mitigating the risk of penalties and fines.

These cost savings allow financial institutions to pursue digital transformation, reinvesting in areas like innovation, customer service, and employee training, creating a virtuous cycle of growth and prosperity.

Ready to unlock the power of automation? Explore intelligent automation solutions that go beyond simple tasks. These solutions can analyze workflows, extract data from documents, and continuously adapt for optimal efficiency.

Contact us at S-Square to learn how intelligent automation can empower your financial institution for a brighter future.

FAQs:

What is akaBot RPA?

akaBot robotic process automation (RPA) software that enables automating repetative tasks. Examples include data entry, report generation, and account reconciliation.

How does AkaBot RPA help financial industries reduce costs?

This software can help financial companies reduce costs by automating repetative tasks, reducing errors, improving accuracy, and enhancing productivity.

How does akaBot Robotic Process Automation (RPA) help financial institutions meet regulatory compliance requirements?

It can help financial institutions meet regulatory compliance requirements by automating the verification and validation of customer data, ensuring that all transactions are processed by regulatory requirements.

What are the benefits of akaBot RPA for financial industry process automation?

The benefits of akaBot RPA for financial industry process automation include cost savings, efficiency gains, improved accuracy, and enhanced productivity.

How does akaBot RPA enable financial institutions to undergo digital transformation?

akaBot RPA enables financial institutions to undergo digital transformation by automating repetative tasks, improving operational efficiency, and enhancing customer service.